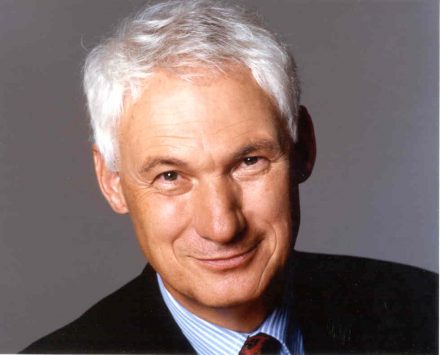

From entrepreneur to venture capitalist – Falk Strascheg, an Austrian by birth and a Munich resident by choice, has an exciting professional career behind him. First, his path took him from Graz to Augsburg, where he worked as an electrical engineer starting in 1962. Several years later, he entered the laser sector in Munich, where he ultimately founded his own company in 1971 – without the benefit of any venture capital, financed independently with a starting capital of 30,000 Deutschmarks. The company, which was profitable right from the start, became a success story and opened subsidiaries in Brussels, Paris and Milan. Today, Falk Strascheg is a venture capitalist in Munich. Munich Startup met up with him for a conversation.

Mr. Strascheg, you built your first company with your own starting capital. Should startups generally follow your example and look into self-financing options first?

No, by no means. Nowadays there are plenty of other financing options, both smaller-scale, in the form of public support, and of course also from venture capital investors. None of that existed at the time.

After your exit, what inspired you to become a venture capitalist? And how is the search for new investment opportunities going?

It was a pretty quick decision, simply because I wanted to invest in young companies again. I made my first investment in 1984. The company I invested in at the time still exists, by the way. At first, I tended to find suitable investment opportunities through accidental discoveries or personal recommendations. In the meantime, we do have a fairly large flow of deals now. We receive about 500 deals a year, which we review. But events like the business plan competition can also help us find new investment possibilities.

What industries do you invest in?

I invest in almost every industry, except for biotech. There’s a simple reason for that: we don’t have the expertise. Otherwise, our portfolio is very broad – it ranges from GPS systems to e-commerce.

And what criteria do you use for your selections? Do you go out and get experts to help you, or do you make gut decisions?

Every so often we consult experts, but for the most part we make the decision ourselves based on the founders’ business plans and pitches.

In your opinion, what does a startup or a founder need to have in order to be interesting for you?

There are three main things:

First: The business or service idea should have certain advantages over the existing offerings. Second: The market for this idea not only needs to be large enough, but also needs to include opportunities for growth. And third: the founders need to be good managers. To me, that means people who are flexible enough to lead a company to success. Who are always rethinking things, checking to see whether they are on the right path, and can make course corrections if necessary.

Let’s say you find this type of founder with real managerial qualities, but you are not 100 percent convinced by the idea and/or the market: can you sometimes still be talked into making an investment?

Not really, but many times startups move in a certain direction, with a certain product idea, and then realize the market isn’t really there yet and the product actually needs to be different. They change and improve their concept, and finally they are successful after all. In the end, I mean when the company has really grown and gotten big, most founders realize that their initial idea has changed quite a bit. That’s where flexibility comes into play again. So sometimes it just takes a few adjustments to the concept before a startup turns out to be interesting for us after all.

Do startups get any coaching or mentoring from you in addition to the financial support?

Yes, we offer both, although they are not our main components. But of course it is also important to share the experiences that we have had.

In the course of your career as an investor, do any startups especially stand out for you?

I’m thinking of two unicorns: one is Intershop, which at times was worth up to 10 billion euros, or at least was traded at that value. And the other is Brokat, which was sometimes also worth up to 5 billion, but is now bankrupt. Ultimately, that company failed because the whole thing got too big and they took out a large loan of 120 million. The creditors were not prepared to make tradeoffs for these bonds, and in the end no one was even willing to take over the company, which turned out to be fatal. Of course, all of that happened after we were already out of the business.

Which sector or industry do you think has a promising future?

I have to say that e-commerce is no longer the “flavor of the month” for venture capitalists. But if there are some good concepts, something really new – and I don’t mean one more hotel platform – then of course e-commerce can still be very interesting.

People always say that Berlin is much more evolved in the e-commerce area than Munich. What do you think?

Yes, that’s true. (laughs)

But your heart is in Munich, and with Munich-based companies. What do you think is good about Munich as a location?

I have to say that we have a very good infrastructure in Munich, with plenty of know-how carriers. In addition, there is traditionally a very large pool of people who work in technology companies, from which people can then be recruited for startups. Last but not least, Munich has a strong university landscape with the Technical University of Munich, Ludwig Maximilian University, and the Munich University of Applied Sciences.

In 2002, you created the “Strascheg Center for Entrepreneurship” (SCE) at the Munich University of Applied Sciences. What was your intention there?

The goal of the SCE is to help students understand entrepreneurial thinking and startup culture. Young people have many good ideas, but sometimes they do not understand that a company is not just created; it needs to be cultivated. It may have something to do with the players’ personal attitudes, but often it also has to do with a lack of know-how. Mentors can be very helpful here.

I believed, and still believe, that a more technically focused university like the Munich University of Applied Sciences, with its many engineers and economists, is a good remedy for this attitude. However, it never would have been possible without the support, commitment and positive attitude of the university’s representatives.

You said mentors can be very helpful. What importance do you assign to networking events?

Very high importance, because in them people can meet others with similar problems and/or specific experience. You can talk to other people at networking events and work together. I think that’s really great.

In your opinion, is Munich missing anything as a startup location?

Every so often it feels like you have to drag the dogs to the hunt here. (laughs) The environmental conditions for new formations are very good in Munich, but often the ambition is lacking. Still, not everyone wants to expose themselves to that much entrepreneurial risk.

For all those who would like to found a company, but are still hesitating: in my opinion, we have plenty of institutions that also teach know-how, like the various entrepreneurship centers at the universities. They don’t just impart knowledge; they also bring decision-makers together. So in Munich, no dog should be scared to hunt.