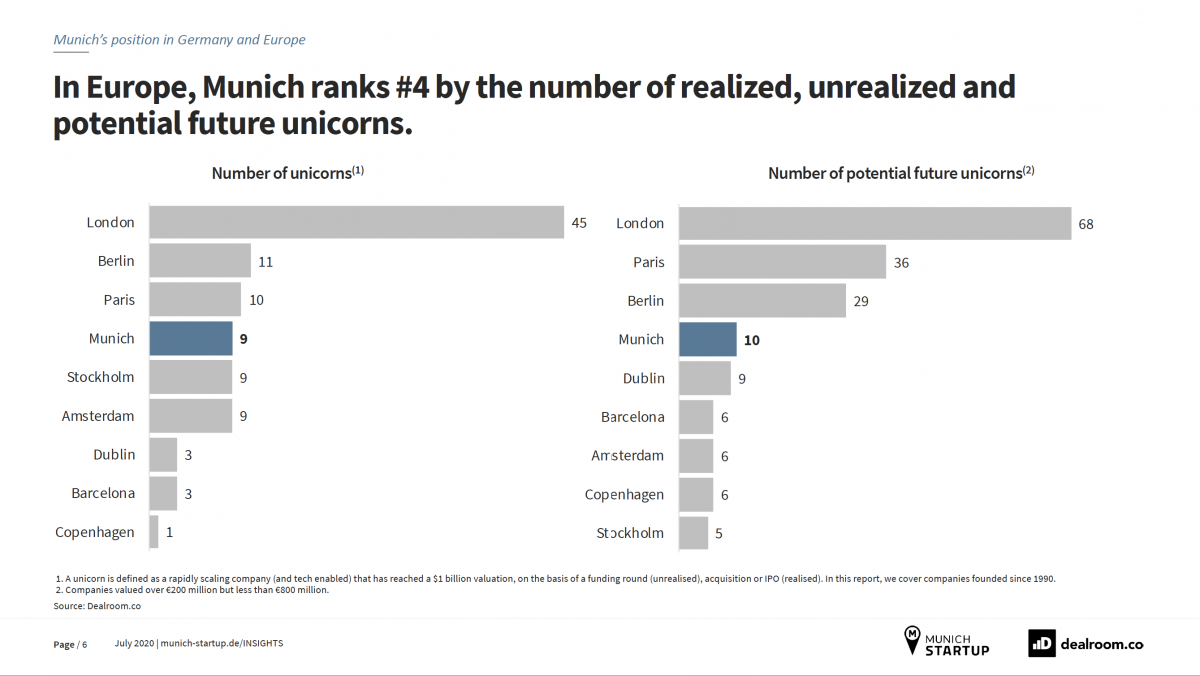

Based on the existing unicorns – which are startups with a valuation of one billion US dollars (800 million euros) or more – Munich takes fourth place in Europe. Only London, Paris and Berlin can currently boast more unicorns. Since counting started in 1990, nine companies in the Bavarian capital have cracked the billion valuation mark. The same number of unicorns are located in Stockholm and Amsterdam, Paris has ten and Berlin eleven. London, in contrast, has 45 unicorns to show, which not only confirms that the British capital plays in a league of its own, but also that continental Europeans have quite a lot of catching up to do.

A similar situation is found when considering potential unicorns in the future. This includes startups whose valuation is between 200 and 800 million euros. London is well in the lead with 68 potential unicorns, Munich comes in fourth with ten such companies. While that will make it possible for Munich to significantly expand its competitive edge towards Stockholm (5) and Amsterdam (6) when it comes to unicorns ahead, the gap between Munich and Paris (36) or Berlin (29) would also widen.

A closer look at the Munich startup scene

The Munich startup scene is characterized by its great diversity: The city has a total of more than 1,300 startups that have created over 15,000 jobs. And there are promising potential unicorns in all industries, such as Yfood in the food sector, Scalable Capital in fintech, Ottonova in healthcare, Leon Nanodrugs in the biotech industry, Personio as a supplier of enterprise software, Sono Motors in the mobility sector, Proglove in Industry 4.0 and Tado as an example for the Internet-of-Things. Add to that 114 local investors and 243 corporates in addition to accelerators, aid organizations and, of course, internationally renowned universities.

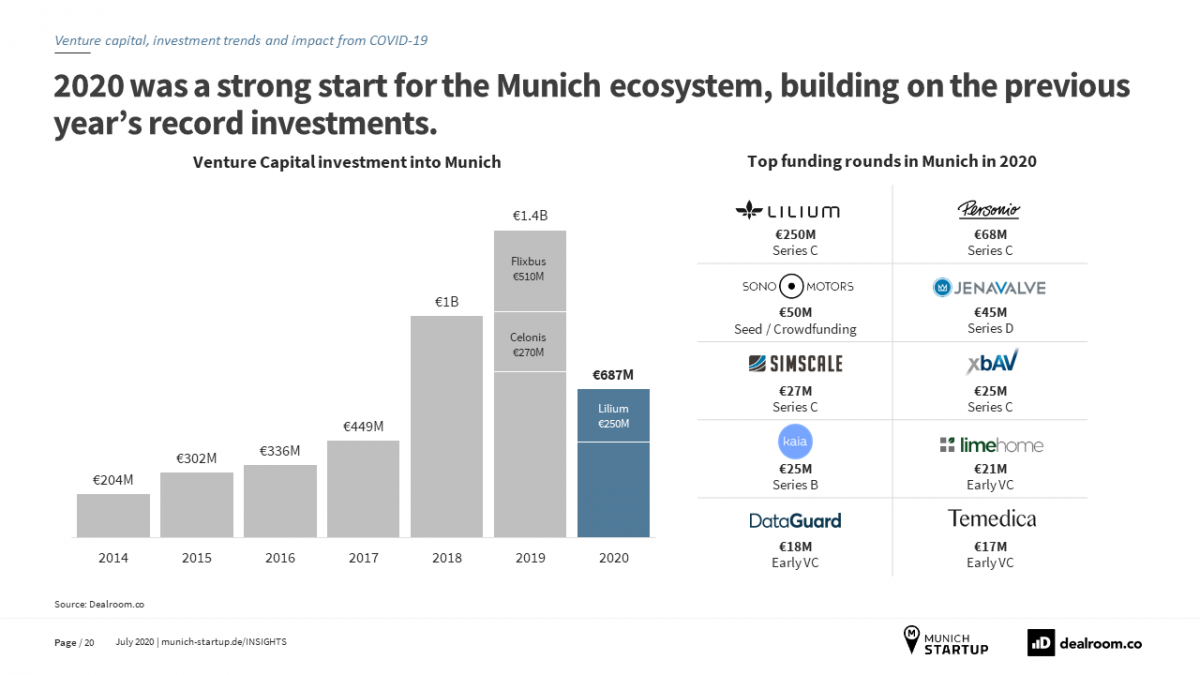

In the last seven years, Munich startups together have reached a total market capitalization amounting to more than 13 billion euros. When it comes to investments, more than 1.9 billion euros were raised in 2019 alone – a sum that might be topped this year despite corona: By mid-2020, the total of all financing rounds for Munich startups already amounted to 687 million euros.

Munich companies are therefore attracting a growing share of the capital invested in startups throughout Germany. While just 11 percent of funds ended up with Munich startups in 2015, a good 21 percent made its way to Munich in 2019. And although 2020 has not ended yet, the share has reached 29 percent. Clemens Baumgärtner, Head of the Department of Labor and Economic Development for the city of Munich, explained:

“The Munich Startup Report impressively demonstrates that Munich has firmly established itself as a European hub for young tech companies. The excellent startup ecosystem in the Bavarian capital helps startups to grow. That means they can mature into unicorns, which brings even more innovative strength and momentum to our city.”

And Gabriele Böhmer, Head of Entrepreneurship Promotion at MGH and Chief Editor of Munich Startup, added:

“The investments in Munich startups as well as the presence of numerous national and international accelerators show that the city is taking on an important role in the startup scene. We have a positive outlook on the years to come, years in which many new startups will certainly be founded in Munich and grow up to become Bavarian unicorns.”

Impact of corona on startups in Munich

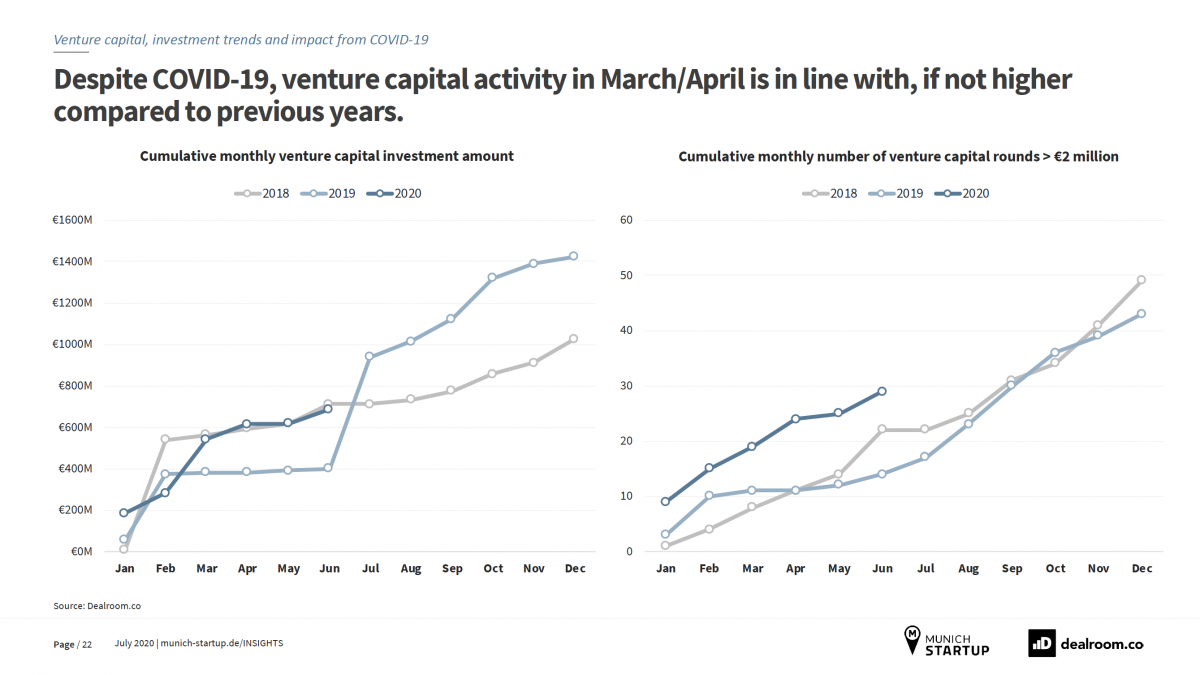

These prospects are hardly dampened by the corona pandemic, because the ecosystem in Munich has fared quite well during the crisis so far. We only need to look at the second quarter of 2020: Total VC investments are at the same level as the corresponding quarters in 2019. That is not only due to the major rounds for companies such as Lilium (35 million US dollars), Xbav (25 million euros) and Kaia Health (23 million US dollars). The number of rounds involving more than 2 million euros and the total number of VC rounds exceed the numbers from last years’ quarters.

Gabriele Böhmer elaborated on the good financing situation:

“Because the healthtech sector is strongly represented in Munich, some startups in the city even benefited from developments caused by the corona crisis. Of course startups in other industries were impacted much more severely by the crisis, the negative effects of which will not be visible in statistics until later. Our Data & Insights Dashboard will be a helpful tool for following the developments to come in the startup scene and drawing definitive conclusions about how well or badly our ecosystem made it through the pandemic.”

About the report

The analysis is based on data from the Data & Insights Dashboard, which was created by Munich Startup and Dealroom.co. Additional project partners are HV Ventures, Target Global, Acton Capital, Point Nine Capital, Lakestar, Handelsblatt Intelligence and WERK1.

Download the entire report here.