What’s the ideal engine to speed up your social vehicle? And which fuel do you need to run it efficiently? While many social entrepreneurs are not aware of their options, there is a suitable funding model for everyone.

Time to investigate which instruments the social finance market has in stock for you. But don’t forget: Before you choose, ask yourself what you really want from your investors.

Guest article by Christina Möhrle, originally published on the Blog ‘Empowering People Network‘ of Siemens Stiftung.

The right time for scaling

Speak to any social entrepreneur who successfully raised impact investment and you will hear several truths. One is that there is a right time for scaling. Another one is that you shouldn’t raise capital unless you really need to. To attract investment is not a gold standard that you have to chase in order to be viewed as a great social entrepreneur.

On the contrary: it comes with risks and side-effects, so it’s good to study the leaflet and consult your inner doctor before taking the pill. Do you want just the check and that’s it? Or do you seek advice, expertise and network on top of the money? Are you willing to get a partner aboard who shares profits and losses? Or is a less engaged loan provider rather your cup of tea?

Pros and cons of different financing instruments and investors

One piece of wisdom is that all financing instruments have their pros and cons – and so do the investors who provide them. Which instrument is the right one for you, is mainly a matter of plans, profiles and preferences. Even a combination of several instruments can be the perfect fuel for a powerful social engine. Therefore – unless you want to risk not seeing the wood for the trees – take a good compass in your hands before you go out in the wild.

Here is some guidance how to find your best way through the thick forest of social finance.

“North”: The legal form

In most countries, there is no such thing as a legal form specific to social enterprises. Instead, they often sit between two stools: should they go for a non-profit or a for-profit structure? For an organization wishing to achieve social impact AND financial profit (no matter how moderate), this state of play is certainly not ideal. It also limits the choice of financing instruments. If you have a non-profit entity, for example, your options are basically grants and donations. Depending on the country you are domiciled in, you may also be allowed to take on a loan.

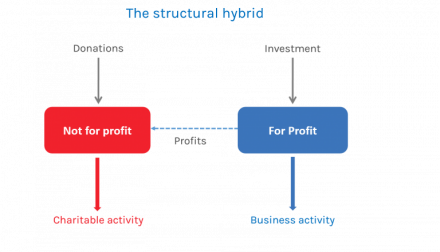

For-profit structures, vice versa, have many choices for repayable instruments, but typically a much lower ability to secure grants and donations. To solve this dilemma, many social enterprises decide to go “hybrid”: They separate their activities into (1) those that are able to generate income and profit, and (2) those that are high-impact but will never become self-sustaining. This kind of legal set-up is called “structural hybrid” or “hybrid organizational model”.

A social enterprise that divides its activities into (1) those that (have the potential to) create substantial revenues and therefore can reach breakeven and become profitable, and (2) those that have no or very low potential for earning any income but that create high impact. These enterprises then set up a for-profit entity for (1) and a non-profit for (2). The hybrid legal structure supports the hybrid business model.

Of course, there’s an additional effort in running two entities instead of just one. But if you strive to scale your impact and need larger sums of capital from outside, walking the extra mile might pay off: The entire universe of funding opportunities opens up.

To read the complete article on the Blog ‘Empowering People Network’ of Siemens Stiftung and get more information about the business model, the stage and the impact of social businesses click here (original english version).

To read the german version click here for part 1 and here for part 2.

About the author

Christina Moehrle started her own shop as a freelance writer and journalist in 2012 to specifically promote social entrepreneurship and impact investing. Since 2014 she additionally takes care of FASE’s communications, papers and blogs. After 15 years as a manager in investor relations, structured finance and venture capital, helping to build the social finance ecosystem has become Christina’s passion and profession.

Christina Moehrle started her own shop as a freelance writer and journalist in 2012 to specifically promote social entrepreneurship and impact investing. Since 2014 she additionally takes care of FASE’s communications, papers and blogs. After 15 years as a manager in investor relations, structured finance and venture capital, helping to build the social finance ecosystem has become Christina’s passion and profession.